#fridayFagPackets: numbers done on the back of one. #YMMV.

Contributors: @dataknut, @tom_rushby

We’ve talked about the cost of retrofitting the nation’s dwelling stock in a couple of places. The first was a reflection on levels of public investment in retrofit compared to the very large sums required and the other was in a de-carbonising the dwelling stock policy tracker. We won’t rehearse the context here – just to say that retrofitting the existing building stock with both fabric-first energy efficiency measures (to reduce the levels of energy needed for comfort) and de-carbonised heat sources to meet the remaining ‘need’ are going to be crucial. We will probably also have to reconfigure ‘comfort’ – is what we normatively ‘want’ actually what we ‘need‘?

But there are a couple of things that got buried in those pieces that deserve a bit more (intense) spotlight:

- what about the individual dwelling level costs and

- does it pay back?

So what will it cost (me) and what is the likely payback period?

On the costs: Elsewhere we’ve estimated what it might cost to retrofit the all of the social rented, private rented and owner-occupied homes that exist. We think it could be around £332 billion based on published government figures. While doing those calculations we’ve noticed some quite large variations in ‘official’ cost estimates. More on that below.

On the payback period: This largely depends on how you value the benefits (obvs ?). For the owner or occupier of the dwelling this is likely to come via reduced energy bills, improved comfort (heat and eat?), potentially reduced exposure to any future Carbon Tax, better health and more. This gives a clue to other values we ought to ‘count’ – like reduced healthcare system costs, reduced carbon emissions, better air quality etc. We can then have fun arguing about whether those ‘social payoffs’ should attract some public £ contribution to the retrofit…

There are also system-level benefits that accrue from better performing homes. These include demand flexibility where use is shifted away from the hours of peak demand and/or periods of low renewables such as cold calm winter evenings. In this scenario payments for demand flexibility will increasingly be passed through to customers who can shift (e.g.. those living in well-insulated homes who can ‘pause’ their heating and not get cold). So not only might your retrofitted home be warmer and cheaper to run, it might also earn you money. More likely, a ‘demand flexibility’ aggregator will subsidise (or pay for) your retrofit and make a margin in the middle by selling your flexibility to the grid.

But for now, let’s not over-complicate. Let’s just consider the simplest personal benefit – reduced energy costs.

Luckily the Energy chapter of the 2018-2019 English Housing Survey (EHS) report has produced some extraordinarily precise model-based estimates of the cost of retrofitting the dwelling stock to ‘an appropriate standard’ using the EPC (SAP-based) ratings data. Thus:

-

- average ‘upgrade‘ costs for EPC bands A-E = ~£13,300

- average ‘upgrade‘ costs for EPC bands F&G = ~£26,800

Interestingly BEIS’ currently live Private Rented Sector Regulations consultation suggests that “on average, landlords will spend ¬£4,700 per property to reach EPC C”. This is some way from the EHS EPC/SAP-based estimates although this may be to do with what exactly ‘on average’ means – the mean cost across all PRS dwellings or the cost per dwelling retrofitted (as in the EHS case).

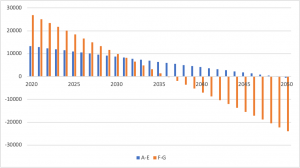

Cost and payback model for an EPC Band A-E dwelling vs F&G retrofitted in 2020 using cost estimate in text: A&E costs less but saves less. It takes 28 years to ‘pay back’…

Turning again to the EHS report we find the estimated average annual energy bill savings to be:

-

- EPC bands A-E = ~£460

- EPC bands F&G = ~£1,690

Now it doesn’t take a rocket scientist to see that an owner of a band A-E dwelling is looking at a very long time (28 years) before they see a financial return (see Figure). For those in the much less efficient F&G bands it is ‘only’ 15.

November 2022 update: the Financial Times now estimates the payback period for some energy efficiency upgrades is now under 10 years thanks to very much higher energy costs. For more detailed modelling see this excellent paper.

So…

…why on earth would anyone do it without any regulatory push or the effective valuation by the property market of the capital investment required? Well, for a start there are the additional benefits we mentioned above – you may even get it done for you if the deal is right….

Of course there are also cultural, social and psychological returns to home improvements. After all, what’s the financial ROI of a new kitchen? But still, 28 (or even 15) years is a long time to not move house (and not die) to see a £ return.

But what’s the bigger picture?

Then there’s the future-proofing element – remember we said de-carbonising the dwelling stock requires both fabric-first retrofit and low carbon heat. With plans to phase out gas boilers, the future looks increasingly likely to be electric heat-pump powered with niche use of other fuels. Heat pumps rely on high thermal-performance buildings and deliver lower temperature water to heating elements to maximise efficiency. Without these, systems will be oversized, locking-in capital intensive systems and unnecessarily high demand for consumers and the energy system alike. Getting this right requires a systemic approach that assesses, plans and implements both high energy efficiency retrofits and low carbon energy input to deliver sustainable comfort services. It takes two to tango, and tango we must.